Стратегии распределения активов

Еще одно любопытное исследование

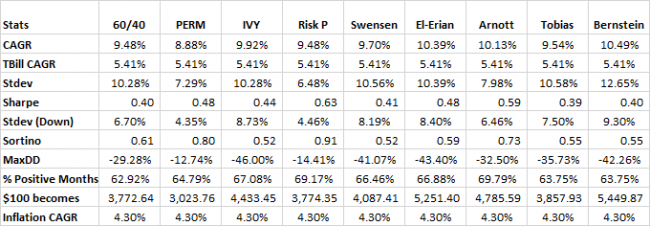

60/40

60% US Stocks

40% US 10 Govt Bonds

Swensen Portfolio (Source: Unconventional Success, 2005)

30% US Stocks

20% REITs

20% Foreign Stocks

15% US Govt Short Term

15% TIPS

El-Erian Portfolio (Source: When Markets Collide, 2008)

15% US Stocks

15% Foreign Developed Stocks

12% Foreign Emerging Stocks

7% Private Equity

5% US Bonds

9% International Bonds

6% Real Estate

7% Commodities

5% TIPS

5% Infastructure

8% Special Situations

Arnott Portfolio (Source: Liquid Alternatives: More Than Hedge Funds, 2008)

10% US Stocks

10% Foreign Stocks

10% Emerging Market Bonds

10% TIPS

10% High Yield Bonds

10% US Govt Long Bonds

10% Unhedged Foreign Bonds

10% US Investment Grade Corporates

10% Commodities

10% REITs

Permanent Portfolio (Source: Fail-Safe Investing, 1981 )

25% US Stocks

25% Cash (T-Bills)

25% US Long Bonds

25% Gold

Andrew Tobias Portfolio (Similar to Bill Shultheis & Scott Burns’s 3 Fund portfolios)

33% US Stocks

33% Foreign Stocks

33% US Bonds

William Bernstein Portfolio (Source:The Intelligent Asset Allocator, 2000 )

25% US Stocks

25% Small Cap Stocks

25% International Stocks

25% Bonds

Ivy Portfolio (Source: Ivy Portfolio, 2009)

20% US Stocks

20% Foreign Stocks

20% US 10Yr Gov Bonds

20% Commodities

20% Real Estate

Risk Parity Portfolio (Unlevered, Faber PPT)

7.5% US Stocks

7.5% Foreign Stocks

35% US 10 Year Bonds

35% Corporate Bonds

5% GSCI

5% Gold

5% Real Estate

ЗЫ правда похожее что то уже обсуждали :)

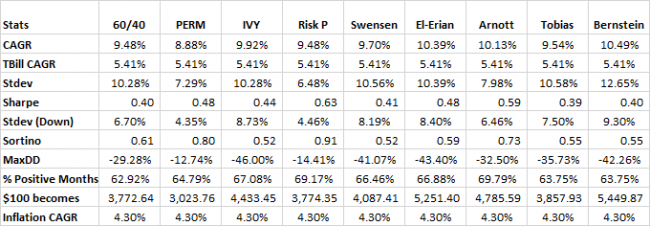

60/40

60% US Stocks

40% US 10 Govt Bonds

Swensen Portfolio (Source: Unconventional Success, 2005)

30% US Stocks

20% REITs

20% Foreign Stocks

15% US Govt Short Term

15% TIPS

El-Erian Portfolio (Source: When Markets Collide, 2008)

15% US Stocks

15% Foreign Developed Stocks

12% Foreign Emerging Stocks

7% Private Equity

5% US Bonds

9% International Bonds

6% Real Estate

7% Commodities

5% TIPS

5% Infastructure

8% Special Situations

Arnott Portfolio (Source: Liquid Alternatives: More Than Hedge Funds, 2008)

10% US Stocks

10% Foreign Stocks

10% Emerging Market Bonds

10% TIPS

10% High Yield Bonds

10% US Govt Long Bonds

10% Unhedged Foreign Bonds

10% US Investment Grade Corporates

10% Commodities

10% REITs

Permanent Portfolio (Source: Fail-Safe Investing, 1981 )

25% US Stocks

25% Cash (T-Bills)

25% US Long Bonds

25% Gold

Andrew Tobias Portfolio (Similar to Bill Shultheis & Scott Burns’s 3 Fund portfolios)

33% US Stocks

33% Foreign Stocks

33% US Bonds

William Bernstein Portfolio (Source:The Intelligent Asset Allocator, 2000 )

25% US Stocks

25% Small Cap Stocks

25% International Stocks

25% Bonds

Ivy Portfolio (Source: Ivy Portfolio, 2009)

20% US Stocks

20% Foreign Stocks

20% US 10Yr Gov Bonds

20% Commodities

20% Real Estate

Risk Parity Portfolio (Unlevered, Faber PPT)

7.5% US Stocks

7.5% Foreign Stocks

35% US 10 Year Bonds

35% Corporate Bonds

5% GSCI

5% Gold

5% Real Estate

ЗЫ правда похожее что то уже обсуждали :)

3 комментария